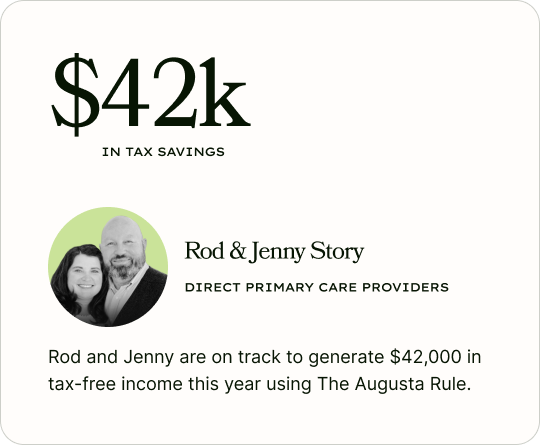

Save Thousands on Taxes by Renting to Yourself.

We make it easy for small business owners to legally reduce their tax bill by $14k-$140k+ every single year by renting their home to their business. No hassle, no hoops, just money in your pocket.

- CPA-Ready

- Compliant with IRS Code

- Fully Bespoke Service

How it Works

1. Plan

We lock in 14 qualifying events for you to host your business at your home and optimize your savings.

2. Host

Host the events at your home. We handle all the legal requirements and documentation.

3. Get Paid

Have your business pay you rental income for the event. We help you set a reasonable price.

4. Deduct & Save

Deduct the rental fee and claim the income tax-free. We work with your tax professional to handle all the reporting.

What is The Augusta Rule?

The Augusta Rule is a provision in the U.S. tax code (Section 280A(g)) that lets homeowners rent their residence for up to 14 days per year without paying tax on that income.

The rule was created in 1976 when homeowners around the Augusta golf course—host to the prestigious Masters Tournament—lobbied Congress to allow them to rent their homes tax-free. (It helped that some congressmen might themselves benefit.)

The law was reaffirmed in 2023, confirming what savvy business owners have been doing for decades.

It’s one of the few legal strategies that turns a business deduction into personal tax-free money.

Calculate Your Savings

1. Select Your Business Type*

Disclaimer: This calculator provides estimates based on current tax rates and should not be considered professional tax advice.

Resources to Help You Save

The Deduction Handbook

This easy-to-navigate guide outlines 72 ways to maximize your tax-free income while building a better business.

TAR Masterclass

This video from our founder walks business owners through using the Augusta Rule to save thousands.

10 Essentials Guide

Navigate the 10 essential requirements every business owner needs to follow to confidently use the Augusta Rule.

Nethaniel Ealy

Founder

John Hyre

Founder

Our Story

As business owners and entrepreneurs who’ve been on both sides of the tax game, Nethaniel Ealy and John Hyre co-founded The Augusta Rule to help others save tens of thousands of dollars.

It all started when Nethaniel received a tax bill bigger than his salary. After 60 pages of tax code, over 100 hours of research, and thousands spent on tax experts, he was no closer to finding a solution. Then he met John.

John Hyre is a nationally respected tax attorney with 30 years of experience who’s taken the IRS to court and won. Together he and Nethaniel developed a comprehensive service that has since changed everything—transforming their own journey and the financial health of many others like them.

Our mission is to put one billion dollars back in business owners’ pockets by 2030.