Business Owners

Your “Free Money” Plan to Save Thousands

Our Done-for-You service for unlocking tax-free income through the Augusta Rule includes coaching, software, scheduling, compliance, and CPA-ready reports.

This isn’t just a tax app. It’s full-service implementation of the Augusta Rule, as permitted by the US Tax Code. We handle the work, you keep time and money.

Free Strategy Call

Free Strategy Call

Custom Rental Comps

Done-for-You

Done-for-You

Software-backed service

Paperwork Compliant

Paperwork Compliant

with IRS Code

Event Scheduling

Event Scheduling

and documentation

What You Get

![]() 45-Minute

45-Minute

Strategy Call

![]() Unlimited Residence & Business Entities

Unlimited Residence & Business Entities

![]() Custom Fair Market Rental Valuations

Custom Fair Market Rental Valuations

![]() Augusta Rule App Software

Augusta Rule App Software

![]() Event Scheduling & Smart Reminders

Event Scheduling & Smart Reminders

![]() Paperwork Compliant with IRS Code

Paperwork Compliant with IRS Code

![]() Pre-Filled Forms & Legally Sound Agreements

Pre-Filled Forms & Legally Sound Agreements

![]() Auto-Generated

Auto-Generated

Invoices

![]() Audit Protection Guarantee

Audit Protection Guarantee

![]() CPA-Ready Reports & Audit Defense Docs

CPA-Ready Reports & Audit Defense Docs

Calculate Your Savings

1. Select Your Business Type*

Disclaimer: This calculator provides estimates based on current tax rates and should not be considered professional tax advice.

Simple Pricing That

Saves You Thousands

You pay 8% of the Deductions you Save

-

-

-

-

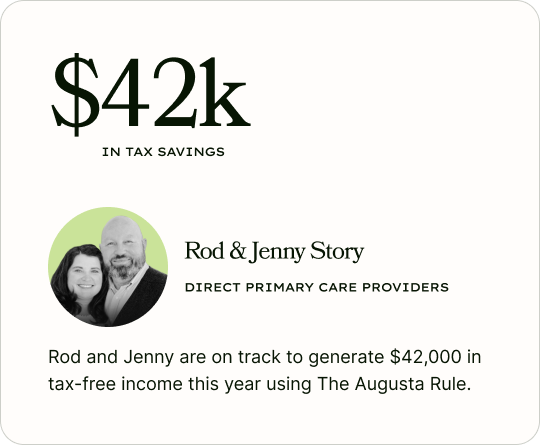

- A $42,000 deduction = a $3,360 fee

- No hourly bills or hidden costs

- Fully customizable savings

- $1000 deposit goes toward your 8% fee

-

-

-

“I co-founded this service to give business owners Fortune 500-level tax compliance without the complexity.”

Backed by Elite Expertise

Most Augusta Rule “solutions” are built by software developers or marketers. Ours was co-founded by someone who has literally fought the IRS in court—and won. Our service is backed by:

- Thirty years of tax law and accounting

- Fortune 500 company tax experience

- A successful track record against the IRS in court

- A personal review of every template, methodology, and compliance requirement in our system